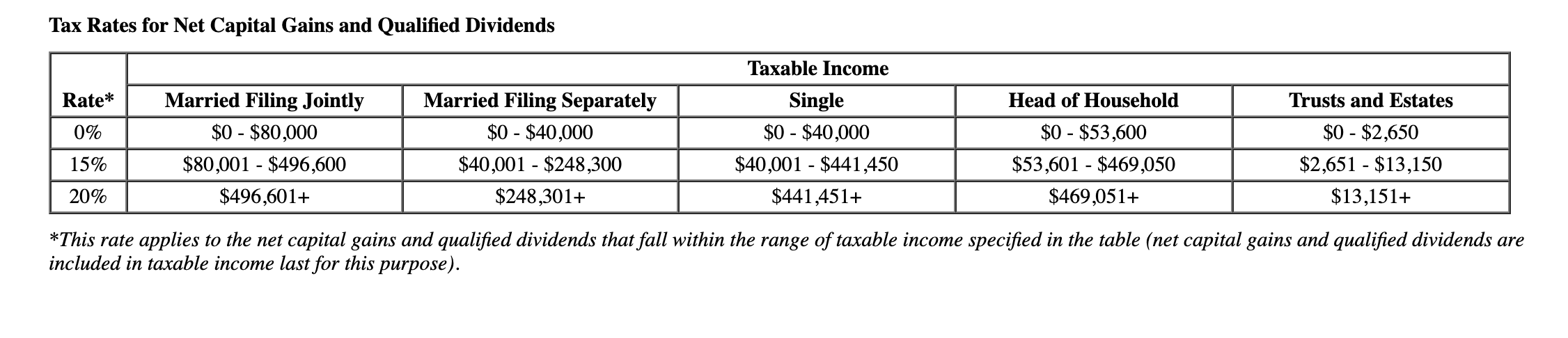

trust capital gains tax rate 2020 table

Its also worth noting that if youre on the cusp of. It applies to income of 13450 or more for deaths that occur in 2022.

Soi Tax Stats Irs Data Book Internal Revenue Service

The tax-free allowance for trusts is.

. For tax year 2020 the 20 rate. Events that trigger a disposal include a sale donation exchange loss death and emigration. The trustees take the losses away from the gains leaving no chargeable gains for the.

2021 Long-Term Capital Gains Trust Tax Rates. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. The annual exclusion for gifts made to noncitizen spouses in 2020 is 157000 increased from 155000 in 2019.

Add this to your taxable income. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. However long term capital gain generated by a trust still.

Capital gains taxes on assets held for a year or less correspond to ordinary. The maximum tax rate for long-term capital gains and qualified dividends is 20. By Soutry Smith Income Tax.

Additionally the 38 Obama-care surtax kicks in at that same top level. 10 and 20 tax rates for individuals not including residential property and carried interest. Trust capital gains tax rate 2020 table Saturday March 19 2022 Edit.

2021 Long-Term Capital Gains Trust Tax Rates Tax documents Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary. The highest trust and estate tax rate is 37. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return.

Trust tax rates are very high as you can see here. The GST tax exemption amount which can be. The following are some of the specific exclusions.

The 2020 estimated tax. The maximum tax rate for long-term capital gains and qualified dividends is 20. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

Because the combined amount of 20300 is less than 37700 the. With trust tax rates hitting 37 at only 12500 its not good to pay taxes out of a trust. The following Capital Gains Tax rates apply.

Trusts and estates pay. What is the long term capital gains tax rate for trusts in 2020. 18 and 28 tax rates for individuals.

Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020. The tax rate works out to be 3146 plus 37 of income. For tax year 2020 the 20 rate applies to amounts above 13150.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000.

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

What You Need To Know About Capital Gains Tax

Mechanics Of The 0 Long Term Capital Gains Rate

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

Solved Required Information The Following Information Chegg Com

The Kiddie Tax And Unearned Income From Scholarships

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2021 Trust Tax Rates And Exemptions

State Corporate Income Tax Rates And Brackets For 2020

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

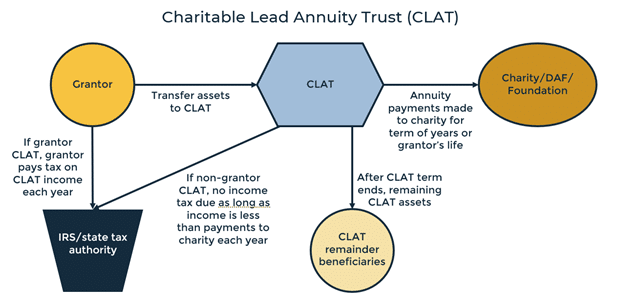

Charitable Lead Annuity Trusts Clats Wealthspire Advisors

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities